GST Rate Finder app will help the consumers and businessmen to find accurate rates of various goods and services. The app has been made available for Android platform and will soon be made available for iOS. The app also works in offline mode.

Ex: Any person who has been billed by a restaurant or a hotel, or for any purchase, can cross-verify the correctness of the rate of GST charged.

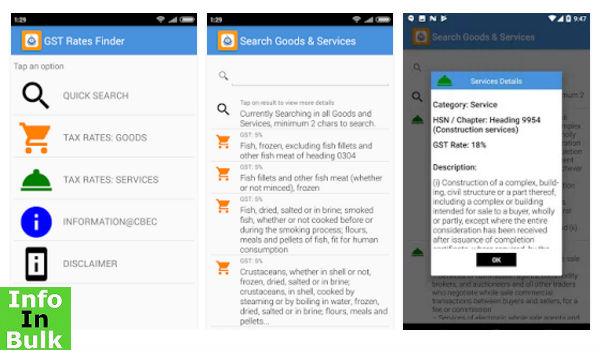

How to use the GST Rate Finder app and find GST rates imposed on various goods and services?

Step 1: Download the ‘GST Rate Finder’ mobile application from Play Store on Android mobile phones.

Step 2: After downloading the app, enter the name or chapter heading of the commodity or service in the search box.

Step 3: The search will immediately list all the names of goods and services, which was entered in the search box.

Step 4: Click on any of the item and a pop-up window will be displayed containing the GST rate of the item.

Step 5: The pop-up window will also contain the description of goods or services and the chapter heading of the Harmonised System of Nomenclature (HSN).

Also, the GST rate finder has been provided on the portal of the Central Board of Excise and Customs (CBEC).

At the portal, a taxpayer can search for applicable CGST (Central Goods and Service Tax), SGST (State Goods and Service Tax), UTGST (Union Territory Goods and Service Tax) rate and the Compensation Cess on a particular supply.