If you need money in an emergency situation, no need to run around or stand in long queues in banks.

Just open Money Tap app, select Amount and click. Money is transferred instantly to your account.

What is Money Tap app?

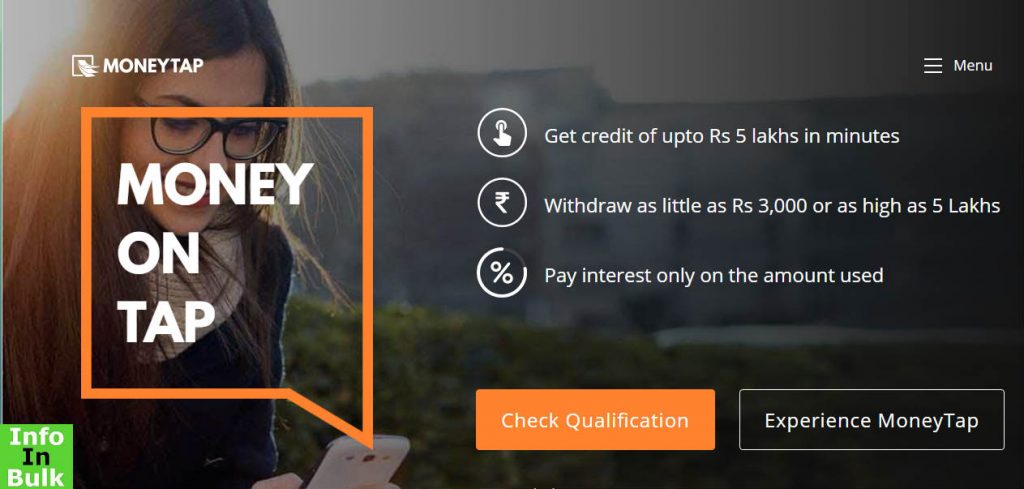

Money Tap app is a money lending app for immediate cash loans in India. Money Tap app is India’s first app, which helps consumers to get the personal credit line from partner bank. It combines the power of a personal loan and a credit card.

How to Use Money Tap app to get instant Cash loans?

First of all, you need to apply for a Credit Line on Money tap app.

FYI.. “Credit Line” means that the bank will issue a limit of up to Rs 5 lakh, without any collateral or charging any interest.

Step 1: Download & Install Money Tap app.

Step 2: Get instant pre-approval of up to Rs 5 Lakh.

Step 3: Upload KYC documents and get final approval.

Step 4: Choose the amount to withdraw and the tenure.

Step 5: Get your money transferred into your account instantly.

Step 6: Repay EMI’s through app.

How does Money Tap work?

• Transfer as low as Rs. 3000, or as high as your credit limit, to your registered bank account.

• Convert your card spends (Rs.3000 or higher) into EMIs right from the app.

• Know all your charges through the MoneyTap app.

Know The Features and Money Tap Customer Care Number

What’s Inside Money Tap App?

Once you download the Money Tap app from the Google Play Store, you need to upload a selfie for the application form, photo of a PAN card and current residence proof for eKYC.

There are mainly three sections in Money Tap app.

1. Profile

2. Credit decision

3. Amount

1. Profile Creation in Money Tap

If you want to get a loan from a bank, then you need to fill a lot of information & submit plenty of documents. But, with Money Tap the process looks simple and fast.

You also need to enter the purpose for which you require a loan.

It will be much easier if you could simply scan the Aadhar card bar-code and all the required information would be fetched from the card.

2. Credit Decision

Once the eKYC is done than the app takes you to the next level, where you can know about the eligibility for the loan as well as sanctioned amount.

In order to perform ‘Eligibility Check’. You need to enter your PAN details, current organization & residence type. Once these details are submitted, the patent-pending algorithms fetch your CIBIL score, social score, etc

CIBIL score might be the first data point used by MoneyTap for checking eligibility for a loan.

If you pass the eligibility check, then you need to submit last six months bank statements. I highly recommend you to use salary account for this as their target market segment is salaried professionals.

There are 2 options for you to upload bank statements.

1. Secure upload link

Money tap will send you a link on your registered Gmail ID to upload your Bank statements. Upon clicking the link, you will be redirected to the secured portal to upload your Bank statements.

2. Net-banking account

The user has the option to either ‘Login to net-banking account’ inside MoneyTap.

MoneyTap has tied-up with a 3rd party company through which ‘Secure Bank statement upload’ as well as ‘Net Banking Login’ is made possible with mandated security standards and robust protocols.

3. Loan Amount

Once both eKYC and Credit Decision steps are completed, the final step is disbursal of approved loan amount.

Note: Interest is only charged for the amount borrowed with interest rates as low as 1.25~1.5% per month.

You can use Money as you like it

Money Tap App– Transfer the amount you need to your bank account instantly.

Money Tap card– Like any other credit card, you can use your card at any retail stores or at online sites. Convert your spends to easy EMI’s.

There is a one-time setup fee of Rs. 499 plus taxes and the customer would get a MasterCard powered credit card by RBL Bank.

Know more about RBL MoneyTap credit card

Follow MoneyTap on